Union Budget 2026-27: FM Announces Semiconductor Mission 2.0, Excise Relief on Biogas CNG

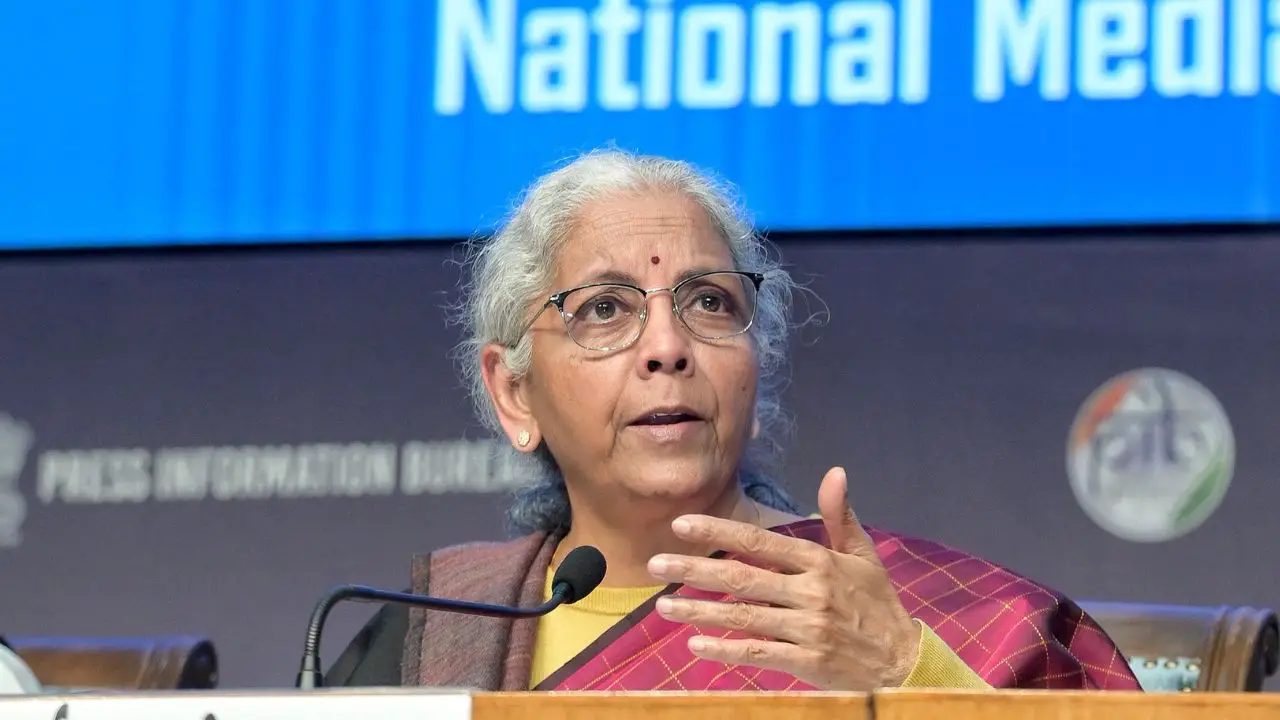

Union Finance Minister Nirmala Sitharaman announced the Budget 2026-27 today, highlighting a range of measures to benefit the auto industry.

By Sanorita

Finance Minister Nirmala Sitharaman has revealed the Union Budget 2026-27, and while it did not address some immediate industry “Wishlist” items – such as a GST cut for hybrid vehicles or a larger FAME 3 subsidy outlay – the government continued to focus on long-term support. In particular, it emphasised helping the auto sector move from simple vehicle assembly to full value-chain ownership, especially in the electric vehicle segment. It aims to accelerate the adoption of alternative fuels while lowering costs across the electric vehicle and battery value chain. Here are the major auto-sector highlights from the Finance Minister’s ninth Budget speech in Parliament.

Union Budget 2026-27: Supporting India’s Semiconductor Self-Reliance

The recently announced budget marked the transition to ISM 2.0, the next step in India’s semiconductor strategy. ISM 2.0 focuses on producing semiconductor capital equipment locally, reducing reliance on a few global suppliers. It also promotes domestic manufacturing of specialty materials, ultra-pure gases, and chemicals critical for cleanroom operations. A key goal is to strengthen full-stack Indian IP, supporting domestic R&D so that chip designs are owned by Indian companies.

Additionally, the government has raised the allocation for the Electronics Components Manufacturing Scheme (ECMS) to Rs 40,000 crore, up from its earlier sanctioned amount of around Rs 22,919 crore when it was first introduced. This increase will support and strengthen domestic production of electronic components such as capacitors, PCBs, and other essential components.

With ISM 2.0, India aims to reduce the long-term cost of ECUs and sensors in EVs and smart vehicles, while strengthening the supply chain against global disruptions.

Union Budget 2026-27: Excise Duty Fully Waived on Biogas-Blended CNG

Another key highlight of this year’s Budget is full excise relief on biogas-blended CNG to make green fuel more affordable and promote waste-to-energy solutions. Previously, excise duty was applied on the entire blended fuel, effectively double-taxing biogas and making green CNG more expensive than regular CNG. Under the new rules, the excise duty applies only to the CNG portion, fully exempting the biogas content.

The move could reduce CNG prices by Rs 2–3 per kg, lower the total cost of ownership for commercial vehicles, support greener public transport, and strengthen energy security by substituting imported natural gas with locally produced biogas.

Union Budget 2026-27: Customs Duty Relief for Mineral Processing Equipment and Lithium-Ion Battery Production

As part of the Budget 2026-27, the government has extended basic customs duty (BCD) exemptions to capital goods used in manufacturing Lithium-ion cells, including those for Battery Energy Storage Systems (BESS). It has also announced an exemption of basic customs duty on capital goods imported for processing critical minerals in India.

Also Read: India-EU FTA Explained: Impact on Car Prices, Imports, and Local Manufacturing

The government has also announced plans to establish Rare Earth Corridors in Odisha, Kerala, Andhra Pradesh, and Tamil Nadu to create hubs for mining and research. This could bring down EV battery costs, paving the way for more affordable electric cars in India.

Union Budget 2026-27: Fueling Growth for MSMEs

Auto MSMEs get a major boost through Budget 2026‑27, which introduced a Rs 10,000 crore SME Growth Fund to provide long-term, patient capital to small and medium enterprises. The Budget also strengthens MSME support by enhancing liquidity through TReDS (Trade Receivables Discounting System) and introducing “Corporate Mitras,” trained professionals in Tier-II and Tier-III towns who will help small businesses manage compliance efficiently and affordably.