India-EU FTA Explained: Impact on Car Prices, Imports, and Local Manufacturing

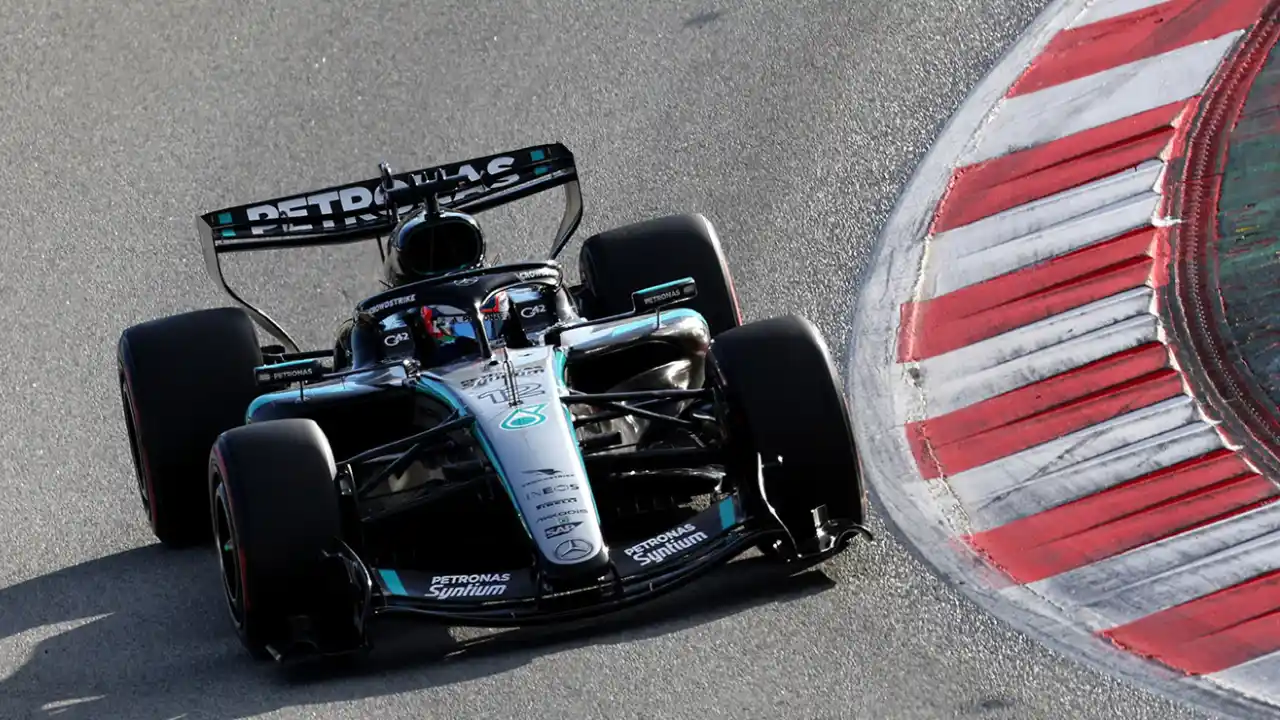

Under the India-EU free trade agreement, import duties on motorcycles and cars from European brands like Ducati, BMW, Mercedes-Benz and Audi could be reduced over time.

By Divyam Dubey

After years of discussions, India and the European Union have finally agreed on a free trade deal, and this one has caught the attention of car buyers and auto industry watchers. The reason is simple. Europe builds many of the cars Indians want, while India remains one of the toughest markets in the world for imports due to high duties. The India–EU FTA aims to ease trade between both sides by cutting tariffs and simplifying regulations. For the auto sector, this could slowly change how European cars enter India. It may not rewrite prices overnight, but it does open the door to a market that has remained tightly shut for decades.

Also Read: Maruti Suzuki Victoris Export Begins from Gujarat

Import Duties Will Reduce

At present, importing a fully built car into India attracts duties of up to 110 per cent. Under the newly concluded India–EU Free Trade Agreement, these tariffs will come down to 10 per cent under an annual quota of 250,000 vehicles. The deal, finalised after nearly two decades of negotiations, sets a clear framework for European car imports while keeping volumes under control.

What does this Mean for Car Prices in India

Lower import duties will bring down the landing cost, especially for fully imported models. Final pricing will still depend on brand strategy, exchange rates and state taxes. So while price drops may not happen overnight, the gap between imported and locally built cars is will shrink over time, giving buyers more choice and better value in the premium segment.

Carmakers may Rethink their India Strategy

The trade deal could push European brands to take a fresh look at their India plans after the tariff drop. With lower duties, it becomes easier to bring in more models and rethink pricing for the market. Some manufacturers may still prefer local assembly to keep costs in check, but the FTA gives brands more room when planning investments and future launches.

Local Manufacturing and Suppliers Stay in Focus

Indian component makers may face added competition, but there is also an opportunity. If more brands increase assembly operations, demand for locally sourced parts could rise. Suppliers that meet EU standards may even gain export access. Safeguard clauses in the agreement allow the government to step in if imports grow too fast, keeping local manufacturing protected as the deal is rolled out in phases.